$tock Market Guru (Lite)

The $tock Market Guru is a Quiz-based investment game to teach and improve your investment skills.

This Lite version does not include al the questions that the Pro version have. The Pro version doubles the quantity of questions in the quiz portion of the game. It also gives you access to a 100 + page PDF document that will answer all of your investment questions. The guide is written for Private Investors to ensure that they will be able to compete with the Professional Investor. It includes the Principles of Successful Investing. As well as a brief overview of the Macro Fundamental Factors; ie the economy. It will teach you how to do a detailed analysis and ratio interpretation of the financial statements. Included is a relatively easy method of calculating the value of a stock and how to select the correct stocks. It furthermore covers many diverse topics that will demystify the stock market. Get your Investment Guide and become a better investor!

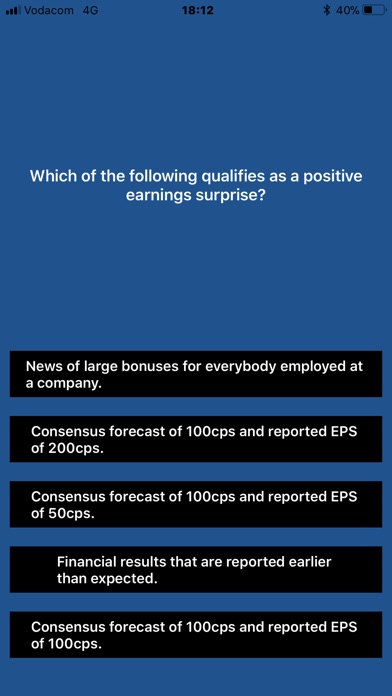

Rules of the game: You receive $10 000 at the beginning of the game. The ultimate goal is to convert this capital to $100 000. This will be done by testing your investment knowledge with an investment quiz. Answering the questions correctly will enhance your odds of positive returns. Thereafter you will be directed to allocate a portion of your capital. This portion will be at risk for that round. Rounds continue in this fashion, but be aware of frequent market surprises.

You will be measured against a target that uses conservative returns. To complete a level you will have to beat this target return. The levels continue until such time that you have finished level 10 and reached $100 000 of capital. Alternatively, until you have failed to beat the target returns. Two factors will determine your success. The first is whether you can correctly answer the majority of the quiz. Your odds of a positive return declines on incorrectly answering the questions.

Secondly, and perhaps of even more importance is your capital allocation. This is done in every round and only impacts that specific round. You can select an allocation anywhere between 10% and 200%. Anything above 100% means you are geared. You are borrowing money to invest and this may be hazardous to your wealth. It is a dangerous position to be in and is therefore not recommended. You will automatically achieve a market related return on your unallocated capital.